Why HOTEL DEVELOPMENTS & HOTEL INVESTMENTS?

IFC’s experience showed that hotel investments hold Vast Potential for Job Creation, and for Economic Stimulus.

The significant benefits of hotel investments are often unnoticed in the tourism industry.

The growing significance of the travel & tourism, and the hotel industry in developing countries highlights the opportunity for further Employment Opportunities, and Economic Growth, especially when a high percentage of the supplies are purchased from the Local Suppliers, and when Local Communities are constructively engaged.

Hotels, Lodges, Camps also play a vital role in sustainable tourism: Ethical Hotel Development (that connects social, cultural and economic factors) and Sustainable Tourism practices are vital factors for both the long-term preservation of culture, and the social-economic stability of the host communities.

Hotels, tourism, and local communities intertwine in close Symbiotic Relationships due to their physical proximity of and inevitable collaboration.

The SDGs (UN sustainable Development Goals) can help hotels define their aspirational purpose, inspire stakeholders at all levels, and increase long-term shareholder value.

SDGs can act as a guideline for hotels to compartmentalize each of their major operational functions (i.e. housekeeping, sales and marketing, client service).

GLOBAL HOTELS

At the end of 2020, the Global Hotel Construction Pipeline stood at 13,943 projects (2,312,410 rooms). [Lodging Econometrics (LE), March 2021]

The hotel developments have been increasing 17.7 % from 2008 to 2018, and with a global pipeline of ±2.4 million new hotel rooms under development.

Furthermore, the hotel sector is made up of almost 200,000 hotels containing over 18 million rooms globally. [International Tourism Partnership, 2020]

The Lodging Econometrics (LE) data: Global Hotel Construction Pipeline Trend Report, also showed the following:

2020: Globally only 562 Hotels (357,769 rooms) opened during the year.

2021: Forecasted that 2,812 hotels (424,844 rooms) to open globally.

2022: Forecasted that 3,255 hotels (498,631 rooms) to open globally.

AFRICA HOTELS

The hotel development pipeline in Africa is still active and dynamic.

Pan-African integration has given an impetus to regional travel in addition to the inbound tourism. The emergence of new private sector airlines in Africa are providing additional flight options, connecting the key airport hubs with key business hubs, and also providing affordable flights to the tourism destinations.

African Continental Free Trade Area (AfCFTA), the largest free trade area in the world, began trading on 01 January 2021, and is expected to speed up the recovery of the continent, and enhance its resilience by increasing the level of intra-African trade in goods and services.

The African Airlines Association (AFRAA) applauded the launch of the Single African

Air Transport Market (SAATM). The operationalization of SAATM the intra-African connectivity can improve, and the aviation/travel sector’s role as an economic driver will grow significantly.

The SAATM would further spur more opportunities to promote intra-African trade, cross-border investments in the production, and the services industries, including tourism.

Increased foreign direct investments, and improved infrastructure in some countries will be driving intra-Africa business travel.

The hotel market in Africa is still under-represented with under-capacity in many cities. Africa makes a very compelling story for us. [Marriott International]

March 2021: STR’s AM:PM records showed that 64,419 hotel rooms are under construction in Africa. [STR]

2019: 401 Hotels (75,155 rooms) in the Development Pipeline. [W-Hospitality]

With the economic growth prospects in Africa, the rapidly growing middle class, young demographic, increased connectivity, and the rapid urbanization, the demand for travel, and for high-quality lodging is growing.

The African continent’s vast, diverse, and rich natural heritage make it an attractive destination for the leisure travellers from around the world.

These circumstances will create significant opportunities to enhance the international hotel chain footprint in Africa. The abundant niche opportunities for iconic independent hotels are attractive prospects.

The hotel sector can also play a crucial part in supporting many emerging businesses & emerging markets across the continent.

AFRICA HOTEL DEVELOPMENT PIPELINE

ACCOR HOTEL GROUP

Plans to open ±57 hotels (±13,500 rooms) in Africa.

BEST WESTERN HOTEL GROUP

18 Hotels (±1,600 rooms) in the development pipeline for Africa.

HILTON

Development plans for ±55 hotels (±11,200 rooms) in Africa.

HYATT

8 Hotels (±1,500 rooms) in the development pipeline for Africa.

IHG INTERCONTINENTAL HOTEL GROUP

10 Hotels (±1,900 rooms) in the development pipeline for Africa.

MANGALIS HOTEL GROUP

15 Hotels (±1,780 rooms) in the development pipeline for Africa.

MANTIS

8 Hotels (±364 rooms) in the development pipeline for Africa.

MARRIOTT INTERNATIONAL

Plans to open ±81 hotels (±16,900 rooms) in the development pipeline for Africa.

Marriott International was the first global hotel chain to make a significant investment on the African continent with the acquisition of Protea Hotels in 2014.

MELIÁ HOTELS INTERNATIONAL

8 Hotels (±2,300 rooms) in the development pipeline for Africa.

MINOR HOTELS

8 hotels (±1,000 rooms) in the development pipeline for Africa.

RADISSON HOTEL GROUP

Plans to open ±50 hotels (±9,000 rooms).

ROTANA HOTELS & RESORTS

Plans to open ±9 hotels (±2,000 rooms).

SWISS INTERNATIONAL HOTELS & RESORTS

Plans to open ±9 hotels (±1,000 rooms).

WYNDHAM HOTELS & RESORTS

8 Hotels (±1,300 rooms) in the development pipeline for Africa.

OPPORTUNITIES

DEMOGRAPHICS

60% of Africa’s 1.25 billion people are under the age of 25, the youngest population in the world [2019 Brookings]

By 2030 Africa will have 17 cities with more than 5 million inhabitants, and also 90 cities with at least one million population.

Africa is one of fastest growing international tourist destinations.

Domestic tourism in Africa is also expected to grow significantly.

World Bank

The potential for tourism growth in SSA is significant.

The region has abundant assets, with expansive beaches, plentiful wildlife, extensive natural & cultural heritage attractions, wellness tourism, and many adventure tourism opportunities. Considerable opportunities for expansion exist in safari, beach, business, and diaspora tourism, including in regions of destination countries that have not yet benefited from tourism.

AFRICA HOTEL DEVELOPMENTS

15 Countries in Africa reported no pipeline hotels in 2019. [W-Hospitality]

Nonetheless, entrepreneurs started to develop hotel properties long before international chains started to focus on Africa.

A few urban conurbations in Africa could reach an oversupply, or nearing a hotel offering capacity situation.

Nonetheless, the abundant rural natural attractions all around the African continent presents many attractive sustainable development opportunities.

AFRICA HOTEL INVESTMENTS

The TIDIA mission is to overcome the particular barriers, and the hotel investment challenges.

TIDIA as a central hub for collaborations, and for the stakeholder facilitations will endeavour to identify creative & novel Enabling Frameworks for hotel investments.

See also the INVESTMENTS page Investments for more information about Investment Opportunities, and Investment Strategies

2020 AHEAD GLOBAL HOTEL OF THE YEAR – Longlist

Global Nominations for THE GAMECHANGER AWARD

2019 AHEAD MEA HOSPITALITY AWARDS – Shortlist

Nominations for Lodges, Cabins & Tended Camps

Shipwreck Lodge – Winner NEW CONCEPT

THE WALL STREET JOURNAL

The 10 Most Intriguing Travel Destinations for 2019

TOWN & COUNTRY

The Best New Hotels in the World 2020

Back to Home Page: Home

AFRICA LODGES & BOTIQUE HOTELS & CAMPS

GLAMPING; The combination of “Glamorous” and “Camping” model (e.g. luxury tented camps) has been used by top tier safari lodges in Africa.

The Glamping phenomenon has proliferated globally in recent years, and many new development projects are being conceived in exotic nature locations.

Following companies are hotel/lodge operators with the largest portfolios in Africa:

AFRICAN BUSH CAMPS

[https://africanbushcamps.com/camps/]

ANDBEYOND

29 Luxury lodges and camps in iconic Africa safari and island destinations.

[https://www.andbeyond.com/our-lodges/]

ASILIA

19 Bespoke camps and lodges in Kenya, Tanzania and Zanzibar (36 lodging options).

[https://www.asiliaafrica.com/camps-lodges/]

ELEWANA

16 Boutique lodges, camps and hotels known for its unique accommodations in iconic locations across Kenya and Tanzania.

[https://elewanacollection.com/]

GONDWANA COLLECTION

20+ Properties (41 accommodation options) spread around the tourist attractions in Namibia.

[https://store.gondwana-collection.com/]

MANTIS

20 Properties in Africa [excluding 4 river boats].

[https://www.mantiscollection.com/]

NATURAL SELECTION SAFARIS

18 Camps in Botswana and Namibia, and one property in South Africa.

[https://naturalselection.travel/travel-type/safari-camps/#]

SINGITA

15 Luxury, award-winning lodges and camps across four countries in Africa.

[https://singita.com/]

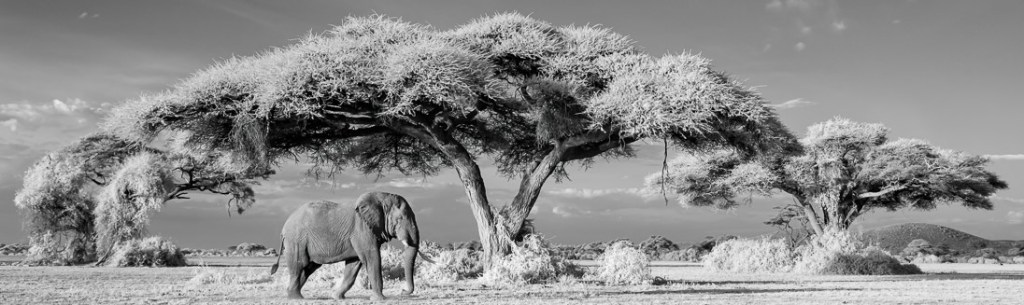

WILDERNESS SAFARIS

A tour operator and destination management company, and Wilderness Air – Operates a portfolio of 60 lodges in Africa.

[https://wilderness-safaris.com/our-camps]

Back to Home Page: Home